PCI DSS 4.0

Simplify PCI DSS Compliance

Expert Guidance. Intelligent Automation. Seamless Audits.

With TrustNet’s Accelerator+, you get end-to-end PCI DSS support — faster audits, fewer errors, and full compliance made easy.

Organizations across industries rely on TrustNet to simplify PCI compliance and protect cardholder data

Your Biggest Compliance Hurdles

Time

Achieving compliance is often a complex and time-intensive process involving detailed assessments, comprehensive documentation, and challenging deadlines.

Complexity

Navigating PCI DSS requirements can be daunting. The technical terminology, frequent updates, and intricate processes often leave organizations feeling overwhelmed.

Ongoing Effort

Compliance is not a one-time event. It requires continuous monitoring, routine reviews, and regular updates to ensure ongoing adherence and proactive risk management.

How TrustNet Helps

Advisory

— Roadmap, Gap Analysis, Remediation

Take control of your compliance strategy with expert guidance. TrustNet uncovers gaps, creates a custom roadmap, and delivers clear, actionable steps to align your business with PCI DSS standards.

Automation

— Reduce manual effort, track controls in real-time

Simplify your compliance process with Accelerator+. TrustNet reduces manual effort, automates control tracking, and keeps you ahead of changing requirements.

Assessment

— Formal audits with 20+ years of PCI QSA experience

Achieve compliance with confidence. TrustNet delivers precise assessments to ensure every PCI DSS requirement is met without complications.

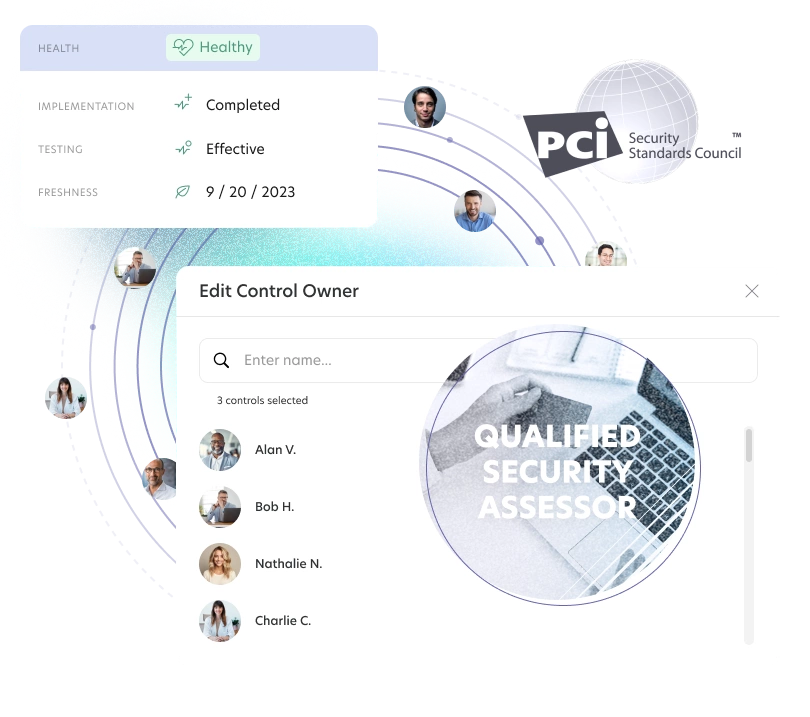

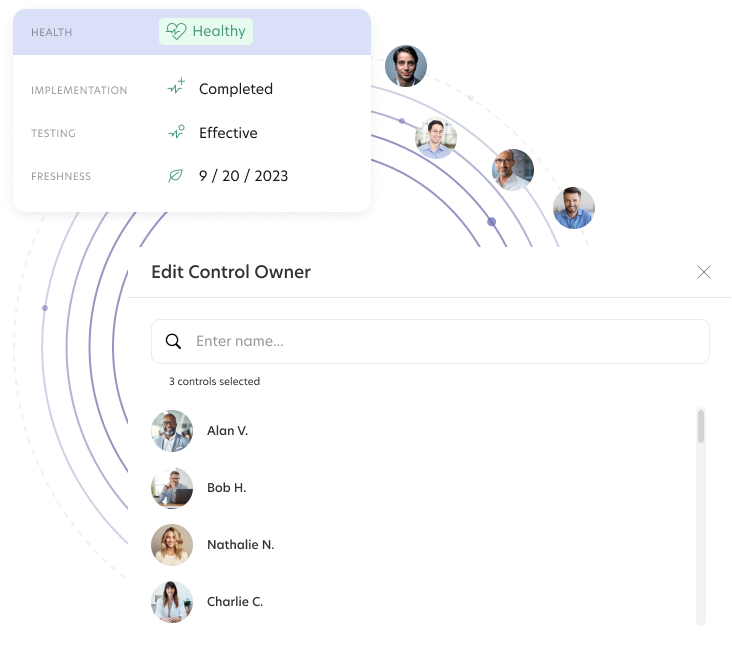

GhostWatch™ | Your PCI Compliance Command Center

Real-time tracking. All-in-one dashboard. Built for compliance at scale.

Core Features:

Policy Builder

Create and customize PCI-compliant policies in minutes. Eliminate guesswork with templates tailored to your needs.

Audit Timeline Tracker

Stay on top of deadlines with a visual timeline that tracks every step of your audit preparation process. Never miss a milestone.

Evidence Collection Module

Simplify audit prep by organizing and storing all compliance evidence in one secure location. Save time when audits roll around.

Live Control Monitoring

Monitor critical controls in real-time to ensure compliance status is always up-to-date. Spot and address issues before they escalate.

Benefits:

Save Over 100 Hours Annually

Streamline compliance prep with automation that drastically cuts manual effort and reduces audit prep time.

Stay Ahead of Deadlines

Avoid last-minute scrambles with tools designed to keep your compliance tasks organized and on schedule.

Reduce Risk and Errors

Gain real-time visibility into control performance to catch potential issues early and ensure nothing slips through the cracks.

Scale Compliance with Confidence

Manage growing compliance demands effortlessly, even as your business expands. GhostWatch is built to grow with you.

The PCI DSS is made up of 12 requirements divided into 6 categories:

These days, cardholder data is safeguarded in several ways, with one of the most important to emerge in recent years being identity and access management (IAM). PCI DSS v4.0 recognizes this priority, aligning with the NIST guidance on digital identities. That is in response to the increased use of cloud-based technologies and the accompanying need for stronger authentication protocols.

Build and Maintain a Secure Network

Protect Cardholder Data

Maintain a Vulnerability Management Program

Implement Strong Access Control Measures

Regularly Monitor and Test Networks

Maintain an Information Security Policy

See how GhostWatch saves hundreds of hours of compliance work

Schedule a Meeting with Us

Accelerate Compliance

In keeping with its ongoing goal of safeguarding cardholder information, the PCI Security Standards Council (PCI SSC) is rolling out a new version of its Payment Card Industry Data Security Standard (PCI DSS). This updated iteration came from extensive feedback from numerous players in the global payments industry belonging to over 200 organizations over three years. With this most recent update comes a transition to outcome-based requirements to meet the security industry’s evolving needs, emphasizing security as a continuous process focusing on flexibility and customizability.

Although only four years have passed since the last version of the standard, v3.2.1, was put in place, tumultuous changes have required a new set of modifications. The COVID pandemic acted as the catalyst for abrupt shifts in shopper behaviors and the embracing of cloud-based platforms that facilitated online shopping and remote work. In keeping with this evolution, cyber attackers also developed ever more sophisticated ways to compromise data and usurp digital systems.

PCI DSS 4.0 Changes

The new emphasis on customizability allows organizations to construct their authentication systems to meet the standard’s requirements and the company’s risk environment. Additionally, PCI SSC is working with Europay, Mastercard, and Visa to implement the 3DS Core Security Standard during the transaction authorization process.

Encryption has long been used to keep cardholder data safe, and the new version of PCI DSS builds on this foundation by expanding on trusted networks. Additionally, the mandate for data discovery for identifying all sources and locations of cleartext primary account numbers has been made more frequent, at least every 12 months, or if the data environment undergoes significant changes.

Multifactor authentication (MFA) for all accounts that can access cardholder data became more stringient

Access privileges must be reviewed at least once every six months

Permissions for the group, shared, and public accounts. Targeted risk analyses aim to allow organizations to establish the frequency of performing certain tasks

It is required that strong passwords for accounts and systems be used

They should be at least 15 characters long, including numeric and alphabetic characters. Additionally, any password must be compared against a list of known bad passwords.

Password protocols require that those used for applications and systems be changed at least every 12 months or if there is suspicion of compromise

Frequently Asked Questions

What if we’ve never done a PCI audit?

GhostWatch, TrustNet’s automation platform, is designed to simplify and accelerate PCI DSS compliance. If you’re new to PCI audits, our PCI QSA experts and the GhostWatch platform will guide you through every step of the process. From assessing your current readiness to identifying gaps and creating a tailored compliance roadmap, we’ll ensure you are fully prepared for your first audit with minimal effort on your part.

Can TrustNet help with remediation too?

Yes, remediation is an integral part of our approach. GhostWatch not only identifies compliance gaps but also provides automated insights and actionable steps to address them. Combined with TrustNet’s expert guidance, the platform ensures quick and efficient closure of gaps, helping you achieve and maintain compliance while optimizing your security posture.

How much effort is needed from our team?

GhostWatch is designed to minimize the workload on your team by automating key aspects of the compliance process, including evidence gathering, policy management, and continuous control monitoring. With TrustNet’s expertise and GhostWatch’s advanced automation capabilities, the heavy lifting is taken care of while your team stays focused on its core responsibilities. Collaboration is required for setup and implementation, but the platform’s efficiency significantly reduces manual intervention.

Is GhostWatch a separate product?

GhostWatch is a product from TrustNet tailored to meet PCI DSS compliance requirements and much more. It serves as a centralized hub for managing compliance, ensuring security, and automating monitoring processes across various regulatory frameworks. With features like Policy Builder, Live Control Monitoring, transparent pricing, and a world-class service team, GhostWatch provides a scalable, cutting-edge solution for compliance automation that extends beyond PCI DSS, meeting diverse organizational needs.

Ready to Make PCI Compliance One Less Thing to Worry About?

Complimentary. No Fees Required.

Schedule a Meeting With Us