Beginner’s Guide: PCI DSS Compliance in 2025

TL;DR

This beginner’s guide breaks down everything you need to know about PCI DSS compliance in 2025, including what the standard is, why it matters, how the 12 core requirements work, what changed in version 4.0.1, and how to achieve and maintain certification. You’ll get a step-by-step roadmap, cost expectations, audit tips, best practices, and expert insights to help your business protect payment data and stay compliant with confidence.

If your business stores, processes, or transmits cardholder data, PCI DSS compliance is not optional; it’s essential. The Payment Card Industry Data Security Standard (PCI DSS) is a global framework developed to secure cardholder information and reduce payment fraud. Created by major credit card companies, this standard applies to all organizations that handle cardholder data, regardless of size or industry.

Why does PCI DSS compliance matter?

-

- It protects sensitive customer data from breaches and theft.

- It reduces the risk of legal penalties, brand damage, and financial loss.

- It builds trust with customers, partners, and payment processors.

For many small and mid-sized businesses, achieving PCI DSS certification can feel complex and overwhelming. That’s where this guide comes in.

You’ll learn:

-

- What PCI DSS is

- The core PCI DSS requirements

- How to become and stay compliant in 2025

- Best practices to streamline your compliance journey

Let’s break it down, step by step.

What is PCI DSS? Understanding the Standard

PCI DSS stands for Payment Card Industry Data Security Standard. It is a global cybersecurity framework developed by the PCI Security Standards Council (PCI SSC). This council includes major card brands like Visa, Mastercard, American Express, Discover, and JCB.

The standard applies to any organization that stores, processes, or transmits payment card data. Its purpose is to protect cardholder data, prevent breaches, and reduce fraud in the payment ecosystem.

The current version, PCI DSS v4.0.1, maintains the standard’s core structure while improving clarity and reflecting modern security practices. All businesses that handle card data must comply with PCI DSS as part of their contractual obligations with payment processors.

Why PCI DSS Matters

-

- It defines a minimum standard for protecting payment card data.

- It helps organizations reduce security risk and operational disruption.

- It supports customer trust and regulatory alignment.

The Six Goals and 12 Core Requirements

PCI DSS organizes its controls under six foundational security goals, supported by 12 core requirements. These have remained consistent through version 4.0.1, though some terms have been modernized.

1. Build and Maintain a Secure Network and Systems

- Install and maintain network security controls

- Apply secure configurations to all system components

2. Protect Account Data

- Protect stored account data

- Protect Cardholder Data with Strong Cryptography During Transmission Over Open, Public Networks

3. Maintain a Vulnerability Management Program

- Protect systems and networks from malicious software

- Develop and maintain secure systems and software

4. Implement Strong Access Control Measures

- Restrict Access to System Components and Cardholder Data by Business Need to Know

- Identify Users and Authenticate Access to System Components

- Restrict physical access to cardholder data

5. Regularly Monitor and Test Networks

- Log and monitor all access to system components and cardholder data

- Test the security of systems and networks regularly

6. Maintain an Information Security Policy

- Support Information Security with Organizational Policies and Programs

Each requirement includes detailed requirements and testing procedures. Together, they create a baseline that organizations can follow to secure payment environments and stay compliant.

Struggling with PCI DSS Compliance? TrustNet Can Help

TrustNet is a trusted Qualified Security Assessor Company (QSAC) and leading cybersecurity compliance partner. We’ve helped businesses of all sizes navigate every stage of the PCI DSS lifecycle

Why PCI DSS Matters: Benefits and Business Impact

PCI DSS compliance is not just about avoiding penalties; it’s a critical part of protecting your customers, your brand, and your bottom line.

The Risks of Non-Compliance

Failing to meet PCI DSS requirements can expose your business to:

-

- Costly data breaches that compromise cardholder data

- Hefty fines from payment brands and acquirers

- Legal liability and increased scrutiny from regulators

- Reputation damage that leads to lost customer trust and revenue

- Termination of merchant accounts, making it harder to accept payments

These outcomes can cripple small and mid-sized businesses.

The Business Value of PCI DSS Certification

Achieving PCI DSS certification delivers real advantages:

-

- Strengthens customer trust by proving your commitment to security

- Reduces fraud risks with better controls and monitoring

- Streamlines partnerships with banks, processors, and vendors

- Improves internal security posture across people, processes, and systems

For merchants and service providers, PCI DSS offers a clear, actionable roadmap to operate securely in today’s threat landscape.

PCI DSS Requirements: The 12 Core Controls

PCI DSS outlines 12 core security requirements, grouped under six control objectives. These controls form the foundation of a secure payment environment. You can view them as both a compliance checklist and a practical guide to securing your systems.

Here’s how these controls connect to your business:

The 12 Core Requirements (Quick Reference)

-

- Install and maintain network security controls

- Apply secure configurations to all system components

- Protect stored account data

- Protect Cardholder Data with Strong Cryptography During Transmission Over Open, Public Networks

- Protect systems and networks from malicious software

- Develop and Maintain Secure Systems and Software

- Restrict Access to System Components and Cardholder Data by Business Need to Know

- Identify Users and Authenticate Access to System Components

- Restrict physical access to cardholder data

- Log and monitor all access to system components and cardholder data

- Test the security of systems and networks regularly

- Support Information Security with Organizational Policies and Programs

What These Controls Mean in Practice

- Operational clarity. These requirements aren’t abstract; they tie directly to business operations. For example, applying secure configurations (Requirement 2) means disabling unused ports\services\protocols, removing or disabling vendor default accounts.

- Reduced risk exposure. Logging and monitoring (Requirement 10) helps you catch threats early. Many SMBs skip this and never detect the breach until it’s too late.

- Streamlined access control. Restricting access (Requirement 7) isn’t just an IT task. It requires alignment across HR, IT, and security to offboard users, define roles, and manage third-party access correctly.

- Faster incident response. Regular testing (Requirement 11) prepares your systems and your team for real-world attacks. Scanning quarterly is good, but testing monthly is better.

- Built-in accountability. Requirement 12 ensures security isn’t a one-person job. Policies, awareness training, and management involvement are essential for long-term success.

PCI DSS Versions: What’s New in PCI DSS 4.0.1?

PCI DSS 4.0.1, released in June 2024 by the PCI Security Standards Council (PCI SSC), is the most current version of the standard. It builds on PCI DSS 4.0 by refining language, correcting formatting issues, and clarifying reporting expectations, without changing the core 12 requirements.

Key Updates in PCI DSS 4.0.1

— Customized Approach Support

Organizations can now implement controls tailored to their unique environments, as long as they meet the intent of each requirement. This gives security teams greater flexibility without sacrificing compliance.

— Stronger Authentication Standards

Multi-factor authentication (MFA) is required for all access into the Cardholder Data Environment (CDE), not just administrative roles. Passwords must be at least 12 characters long.

— Targeted Risk Analysis (TRA)

Businesses must conduct specific risk assessments when applying flexible controls or determining control frequencies. TRA ensures security decisions reflect real operational risk.

— Improved Documentation and Scope Validation

The update emphasizes detailed reporting, clearer role assignments, and stronger evidence for control effectiveness. This helps businesses and assessors maintain accuracy during audits.

— Deadline for Compliance

Starting March 31, 2025, PCI DSS v4.0.1 becomes the mandatory standard for all organizations in scope. Version 4.0 has officially retired.

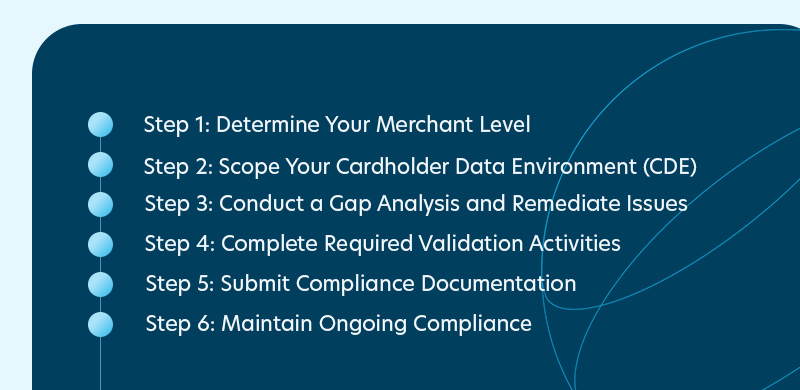

The PCI DSS Compliance Journey: Step-by-Step Roadmap

Here’s a step-by-step roadmap to guide your path to PCI DSS certification.

Step 1: Determine Your Merchant Level

Payment brands assign merchant levels based on annual transaction volume, which affects your validation requirements.

- Level 1 – Over 6 million Visa or Mastercard transactions annually, or any merchant deemed high risk.

Must complete a full PCI DSS audit by a Qualified Security Assessor (QSA).

- Level 2 – Between 1 million and 6 million transactions annually.

May use a Self-Assessment Questionnaire (SAQ) or undergo a QSA-led assessment.

- Level 3 – 20,000 to 1 million e-commerce transactions annually.

Typically eligible to complete an SAQ.

- Level 4 – Fewer than 20,000 e-commerce or up to 1 million total transactions annually.

SAQ is required if mandated by your acquiring bank.

Step 2: Scope Your Cardholder Data Environment (CDE)

- Identify all systems, people, and processes that store, process, or transmit cardholder data. This includes payment applications, POS systems, cloud environments, and vendors.

Step 3: Conduct a Gap Analysis and Remediate Issues

- Use the official PCI DSS compliance checklist or work with a QSA to review existing controls. Identify gaps, prioritize remediation, and align your environment with all applicable requirements.

Step 4: Complete Required Validation Activities

- Submit the correct SAQ or undergo a Report on Compliance (RoC) with a QSA.

- Run quarterly external vulnerability scans through an Approved Scanning Vendor (ASV).

- Run quarterly internal authenticated vulnerability scans

Step 5: Submit Compliance Documentation

- Prepare and submit your Attestation of Compliance (AOC) and required documentation to your acquiring bank or payment brand.

Step 6: Maintain Ongoing Compliance

- Compliance is not one-and-done. Continuously monitor systems, update security policies, retrain staff, and stay ahead of evolving threats.

PCI DSS Audit, Cost, and Tools

Completing a PCI DSS audit is a critical step toward certification. It validates that your controls meet the required security standards and confirms your eligibility to process, store, or transmit cardholder data.

How Long Does It Take?

The audit and certification process typically takes 1 to 2 months, depending on your environment’s size, complexity, and current security posture. Preparation time varies based on how much remediation is needed after your gap analysis.

What Does It Cost?

PCI DSS audit costs range from $10,000 to over $100,000, based on:

-

- Merchant or Service provider level and transaction volume

- Scope and system complexity

- Number of in-scope locations

- QSA involvement and service fees

- Internal readiness and tooling

A Smarter Way to Prepare: GhostWatch by TrustNet

GhostWatch is TrustNet’s Managed Security and Compliance Platform that transforms how organizations manage PCI DSS compliance.

-

- 24/7 monitoring to detect vulnerabilities in real-time

- Automated evidence collection to cut manual effort

- Custom-fit frameworks that match your unique infrastructure

- Live dashboards and audit-readiness scores to track progress

- Integrated security intelligence that prevents issues before they derail audits

GhostWatch doesn’t just help you pass the audit; it empowers you to build a sustainable, audit-ready environment year-round.

Best Practices for PCI DSS Success

Long-term PCI DSS compliance success depends on consistency, visibility, and smart planning. These best practices help you stay audit-ready and security-focused year-round.

1. Start with a Readiness Assessment

-

- Evaluate your current environment against PCI DSS requirements.

- Identify control gaps, high-risk areas, and opportunities for scope reduction.

2. Define and Document Every Control

-

- Maintain clear documentation for all policies, procedures, and system controls.

- Ensure process owners understand and regularly review their responsibilities.

3. Automate What You Can

-

- Use tools like GhostWatch to run scheduled vulnerability scans and monitor system logs in real-time.

- Automate evidence collection to reduce audit preparation time and eliminate manual errors.

4. Build a Culture of Security Awareness

-

- Yearly training for employees in data protection and security roles.

- Reinforce policies with ongoing education, not just annual check-the-box sessions.

PCI DSS Beginner FAQs

— Who needs PCI DSS compliance?

Any organization that stores, processes, or transmits payment card data must comply. This includes merchants, payment processors, service providers, and third-party vendors.

— What are the merchant levels?

Merchant levels are based on annual transaction volume. Level 1 handles over 6 million transactions and requires a full audit. Levels 2–4 may qualify for self-assessments depending on their size and processing methods.

— How long does PCI DSS compliance take?

The timeline varies, but most organizations complete the process in 1 to 2 months. Readiness, scope, and control maturity affect how long it takes.

— What’s the difference between an SAQ and a QSA assessment?

An SAQ (Self-Assessment Questionnaire) is for eligible merchants with lower transaction volumes. A QSA assessment involves a third-party auditor reviewing your environment and issuing a formal Report on Compliance (RoC).

— What are common PCI DSS audit pitfalls?

Key issues include no regular monitoring and checks, poor documentation, incorrect scope definition, weak authentication controls, and outdated vulnerability scans.

— Can PCI DSS compliance be automated?

Yes, with the right tools. Platforms like GhostWatch by TrustNet automate evidence collection, continuous monitoring, and audit readiness, reducing workload and increasing accuracy.

What to Do Next: Your Path to PCI DSS Compliance

PCI DSS compliance is a business-critical investment in protecting payment data, earning customer trust, and staying competitive. Whether you’re launching a new product, scaling your e-commerce platform, or managing legacy systems, now is the time to act.

Start by identifying your gaps, defining your scope, and building a compliance strategy that fits your business goals.

Request a free consultation with a TrustNet expert. Get a personalized roadmap, actionable insights, and direct guidance from a Qualified Security Assessor who has helped hundreds of businesses achieve and maintain PCI DSS certification with confidence.

Subscribe to the TrustNet Newsletter

actionable cybersecurity strategies, and TrustNet’s cutting-edge solutions.